The Archbishop of Canterbury has urged the government to put the interests of customers before shareholders of water utilities.

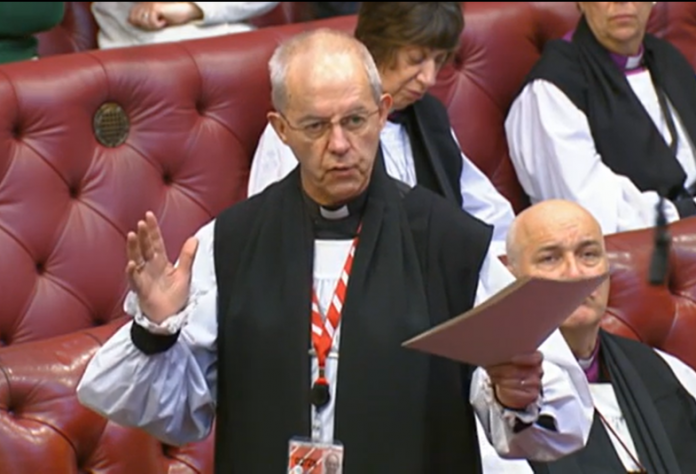

Speaking in the House of Lords on 23 July 2024, the Most Rev Justin Welby congratulated Baroness Hayman, the Labour government’s new Parliamentary Under-Secretary of State for Environment, Food and Rural Affairs upon her appointment, and noted his interest in the point raised by Baroness Blower that: “All water companies are using financial engineering to overstate their investment and capacity to pay dividends. They all capitalise part of their interest payments, which is, frankly, a highly imprudent policy and was a major reason for the collapse of Carillion. Are the Government content with that?”

The archbishop told the Lords: “I join in congratulating the noble Baroness on her appointment. Picking up on the previous question, which is very much the point, is it not true that the shareholders of Thames Water and others have made extraordinary returns by financial engineering, well in excess of what one would expect to make from a utility, which should be low risk and low reward? In looking at the future structure, will the Government put in place measures to prevent the over-return to shareholders by means of financial engineering, and limit the upside so that utilities are run basically for their customers and not simply for the short-term gain of those who have them?” (HL Deb, 23 July 2024, c366)

Lady Hayman said the archbishop made an “extremely good point”.

“There are clearly serious problems in the water industry that have been building up for a number of years.

“We are looking at all options and ways forward to improve the situation and, clearly, modelling how companies operate will be part of those discussions.”

Lady Hayman added: “The problem is, we should have had firm action from Government to ensure that there was action taken much earlier to make sure that money was actually spent properly on fixing the system, rather than paying dividends and bonuses to company shareholders and actually not looking at how the company was being financially operated in a way that works for both customers and for the environment.”