If these claims are correct, the Church’s £440 million claim used to justify its £100 million expenditure today is wildly wrong

In January last year, the Church Commissioners, who run the Church of England’s investments, published a report into one of their main predecessors, Queen Anne’s Bounty. The report said the Bounty had invested the rough equivalent of £440 million today in the slave trade, via the South Sea Company, between 1720 and 1740.

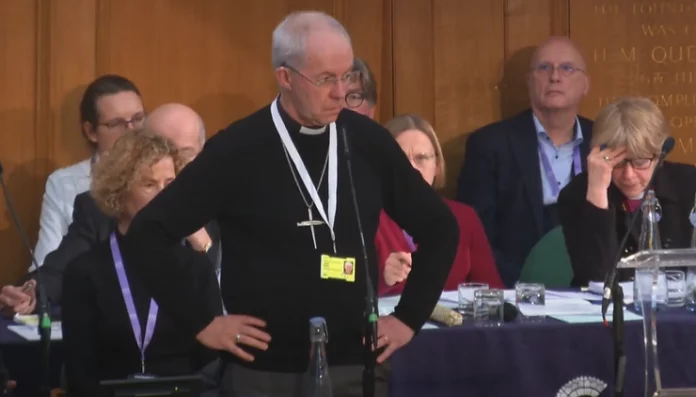

The Archbishop of Canterbury, Justin Welby, said, “I am deeply sorry for these links”. In atonement, the Commissioners committed £100 million to a nine-year programme of “impact investment, research and engagement”. This decision was not universally acclaimed by ordinary Anglicans. Parishes are getting poorer. Many felt that any sums available should be spent on Christian ministry today rather than righting wrongs committed 300 years ago.

The top brass prevailed over the poor bloody infantry, however. The £100 million programme is going ahead. Money is also being spent on recruiting “racial justice” officers [see my columns of March 5 and 19] to preach to the heathen, better known as the man or woman in every pew in England, about “deconstructing whiteness”.

The report’s foreword spoke of the modern-day Church’s “commitment to truth-telling” to attain “Sankofa”, a Ghanaian word meaning “looking back to move forward to a better future”. But is the history contained in the report true? In a recent article in the Church Times, Prof Richard Dale, a business historian of the famous “South Sea Bubble” of 1720, suggests it is not. I telephoned him to find out more.

Prof Dale notes that the Commissioners’ report was not peer-reviewed before publication, a process which proper academic articles must undergo. He praises the diligence of the report’s research, carried out by the accountants Grant Thornton, on details of the Bounty’s investments, but raises the absence from its work of a different, crucial dimension which peer reviewers would have noticed.

This is the fact that, in 1723 – three years after the South Sea Bubble had burst – Parliament passed a statute splitting the South Sea Company in two. One was the trading company. The other was the company which sold what was in effect government debt, paying interest on annuities.

The Commissioners’ report says that “anyone investing in the Company before 1740 was consciously investing in these [slave-trading] voyages.” Prof Dale says the opposite was the case. Those buying the annuities were consciously not investing in slavery. The statute’s purpose was to

make this possible by what is now called “ring-fencing”, preventing any financial or legal relationship between the trading and the annuities. This was done, it seems, because the trading (of which slaves formed a big part, but not the whole) was high-risk. The smash of 1720 had showed how toxic the mixture of government debt with high risk could be.

After the Act, Queen Anne’s Bounty put all its money into the annuities – just the sort of lower but safer return you would expect a sober ecclesiastical organisation to seek. Once the split had taken place, it bought no shares in anything connected with slavery.

Between 1720 and 1723, it is true, the Bounty did invest £14,000 (about £2.4 million today) in the unsplit company and so, for a time, could have profited from slavery. As it happened, however, it did not. When Parliament divided the South Sea Company in 1723, it split the Bounty’s shares equally, too. The Bounty sold off its trading company shares quite quickly but retained and greatly expanded its annuities.

Discreditably, the Bounty’s managers in 1720 appear to have felt no moral qualms about the slave trade. Subsequently, however, they did not further invest in it or make money out of it.

The Commissioners’ report also argues that the Bounty received tainted money, because benefactors supporting its main purpose – help for poor clergy – were often rich from slavery. This is presumably true, but it is separate from and secondary to the report’s main charge.

I do not think Prof Dale’s objections are quibbles. If correct, the Church’s £440 million claim used to justify its £100 million expenditure today is wildly wrong and Queen Anne’s Bounty is not guilty as charged. The Church Commissioners did not ensure the full, truthful research necessary.

The report says, “a significant portion of the Bounty’s income … was derived from sources that may be linked to transatlantic chattel slavery, principally interest and dividends on South Sea Company

annuities”. That word “linked” is weaselly. The annuities were not meaningfully linked to slavery and the Commissioners were in a position to know that. So what is left of their chief accusation?

This is not the first time a Church attempt to repudiate its past has led it to be unfair. In recent years, the hierarchy posthumously accused Bishop George Bell of Chichester of child abuse. After repeated denials, they finally admitted their claims were baseless, and had been made without proper process.

The claim the hierarchy now makes about Queen Anne’s Bounty seems similarly unfair, and motivated, as was the Bell case, more by a desire to look good than by a zeal for truth. You might call it moral Bounty-hunting.

Besides, £100 million is an awful lot to splash out on a false premise, especially when the real needs of clergy and their flocks are so great.

So far, no bishops or archbishops have commented publicly on Prof Dale’s work. Until they do, a significant cloud hangs over the Church Commissioners’ report.

Read it all in the Daily Telegraph

[…] Source link […]